The Basic Principles Of Estate Planning Attorney

The Basic Principles Of Estate Planning Attorney

Blog Article

Fascination About Estate Planning Attorney

Table of ContentsUnknown Facts About Estate Planning Attorney7 Simple Techniques For Estate Planning AttorneyFacts About Estate Planning Attorney RevealedAn Unbiased View of Estate Planning Attorney

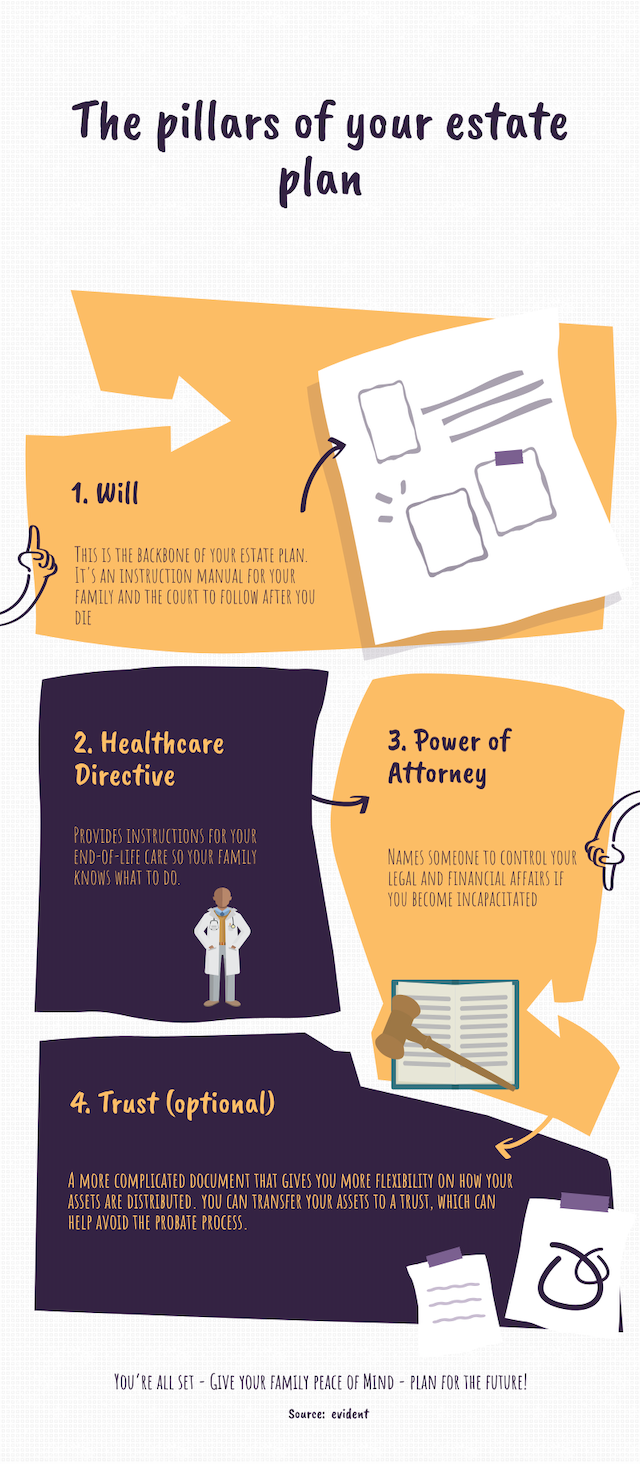

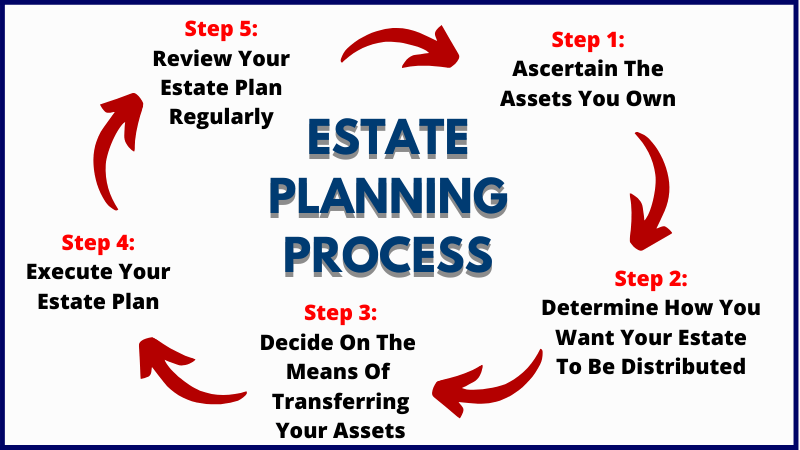

Estate planning is an action plan you can use to determine what happens to your assets and obligations while you're alive and after you die. A will, on the other hand, is a legal document that describes how assets are dispersed, that takes treatment of youngsters and pet dogs, and any kind of various other desires after you die.

The executor likewise needs to repay any taxes and financial debt owed by the deceased from the estate. Creditors typically have a restricted quantity of time from the day they were notified of the testator's death to make insurance claims versus the estate for cash owed to them. Cases that are rejected by the executor can be taken to court where a probate judge will have the final say as to whether or not the case stands.

Excitement About Estate Planning Attorney

After the inventory of the estate has been taken, the worth of possessions determined, and taxes and debt repaid, the administrator will certainly after that look for consent from the court to disperse whatever is left of the estate to the recipients. Any inheritance tax that are pending will certainly come due within 9 months of the date of death.

Each individual areas their possessions in the count on and names someone various other than their partner as the recipient., to support grandchildrens' education and learning.

Estate Planning Attorney Things To Know Before You Get This

Estate organizers can deal with the benefactor in order to reduce gross income as an outcome of those payments or develop approaches that make best use of the effect of those donations. This is an additional technique that can be made use of to limit death tax obligations. It involves a private securing in the current value, and therefore tax obligation liability, of their property, while associating the worth of future growth of that funding to an additional person. This method includes cold the worth of an asset at its value on the date of transfer. Appropriately, the quantity of potential capital gain at death is blog additionally iced up, allowing the estate coordinator to approximate their possible tax obligation liability upon death and much better strategy for the settlement of income taxes.

If sufficient insurance policy profits are available and the policies are properly structured, any kind of revenue tax obligation on the regarded personalities of properties complying with the death of a person can be paid without resorting to the sale of assets. Proceeds from life insurance coverage that are obtained by the recipients upon the death of the guaranteed are normally earnings tax-free.

Various other charges related to estate preparation consist of the preparation of a will, which can be as low as a few hundred dollars if you use one More Bonuses of the best online will certainly manufacturers. There are particular documents you'll require as component of the estate preparation process - Estate Planning Attorney. Some of the most usual ones consist of wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a myth that estate preparation is only for high-net-worth individuals. Estate preparing makes it simpler for people to identify their wishes prior to and after they die.

6 Easy Facts About Estate Planning Attorney Explained

You should start preparing for your estate as quickly as you have any kind of quantifiable asset base. It's a recurring procedure: as life progresses, your estate plan ought to move to match your conditions, in line with your brand-new objectives.

Estate preparation is often assumed of as a device for the well-off. Estate preparation is likewise additional resources an excellent method for you to lay out strategies for the treatment of your minor children and pets and to outline your dreams for your funeral service and preferred charities.

Applications have to be. Eligible applicants who pass the examination will certainly be officially certified in August. If you're qualified to rest for the exam from a previous application, you might file the short application. According to the guidelines, no qualification shall last for a duration longer than 5 years. Discover when your recertification application is due.

Report this page